India’s Power Sector

As on 31.03.2025

Target for FY 2025-26

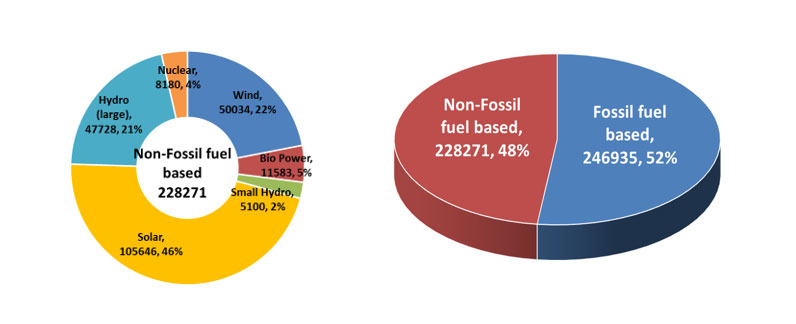

Installed Power Generation Capacity:

Fossil fuel based: 2,46,935MW

Non-Fossil fuel based: 2,28,271MW

Installed Power Generation Capacity:

Conventional: 12,860MW

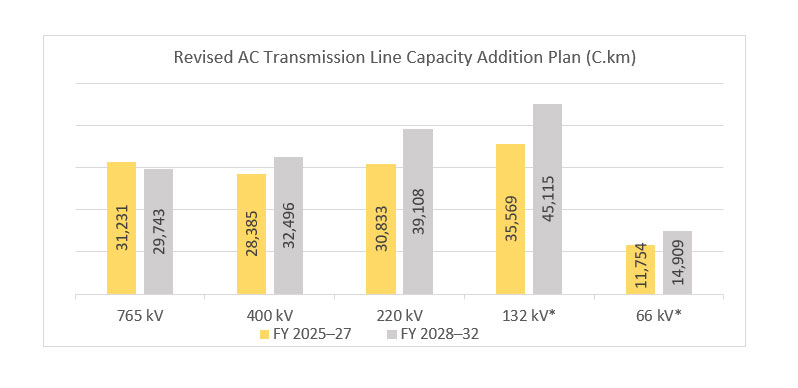

AC Transmission Lines: 4,94,374ckm

HVDC : 19,375 ckm

765 KV : 56,955ckm

400 KV : 2,06,792ckm

220 KV : 2,11,252ckm

AC Transmission Lines: 24,400ckm

HVDC : NIL

765 KV : 12,865ckm

400 KV : 5,933ckm

220 KV : 5,602ckm

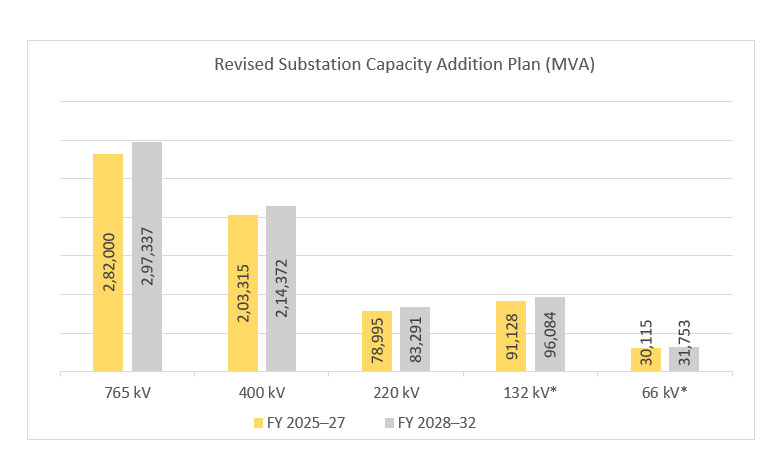

AC Substation Transformation Capacity:

12,47,488 MVA

HVDC: 32,500 MW

765 KV : 2,99,819 MVA

400 KV : 4,72,376 MVA

220 KV : 4,75,293MVA

AC Substation Transformation Capacity:

197617MVA

HVDC : NIL

765 KV : 1,03,000MVA

400 KV : 62,150MVA

220 KV : 32,467MVA

Power Sector

- India stands 4th globally in Renewable Energy Installed Capacity (including Large Hydro), 4th in Wind Power capacity & 4th in Solar Power capacity.

- India is the third-largest producer and consumer of electricity worldwide, with an installed power capacity of 4,75,206 MW as on Mar 25.

Summary of Distribution Infrastructure Planned (As on March 2022 and March 2030)

Sr

Description

Unit

March-22

March-22

%age Increase

1

Substation Count (66/33/22 KV)

Nos

39,965

52,157

31%

2

Substation Capacity (66/33/22 KV)

MVA

4,82,810

6,24,332

39%

3

Feeders (66/33/22 KV)

No

36,804

54,639

48%

4

Feeders (66/33/22 KV)

CKM

5,89,304

7,77,994

32%

5

Feeders (11 KV) Nos

NOS

2,30,979

3,23,899

40%

6

Feeders (11 KV) Length

CKM

49,35,279

59,03,782

20%

7

Distribution Tranformer (DT) Count

NOS

1,46,74,261

1,93,32,115

32%

8

Distribution Tranformer (DT)

MVA

6,89,192

9,27,656

35%

9

LT Feeders (1-Ph & 3Ph)

CKM

79,45,758

97,74,634

23%

10

Capacitor Bank

MVAR

59,255

1,05,209

78%

11

Consumer (in Crores)

Nos

33

52

58%

Growth Drivers

- Higher investments: As per the National Infrastructure Pipeline 2019-25, energy sector projects accounted for the highest share (24%) out of the total expected capital expenditure of Rs. 111 lakh crore (US$ 1.4 trillion). Total FDI inflow in the power sector reached US$ 16.58 billion between April 2000-March 2023.

- Policy support: Electrification in the country is increasing with support from schemes like Deen Dayal Upadhyay Gram Jyoti Yojana (DDUGJY), Ujwal DISCOM Assurance Yojana (UDAY), and Integrated Power Development Scheme (IPDS).

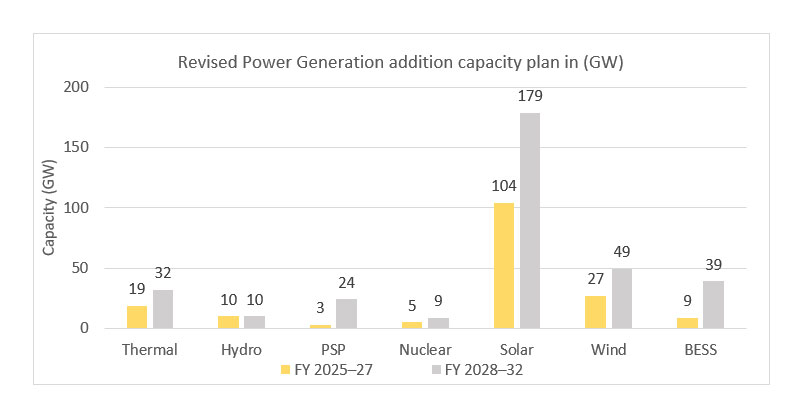

530 GW of renewable energy capacities to be achieved by 2030

- As per National Electricity Plan, projected capacity during 2022-27 for conventional & RE sources will be 211,819 MW comprising 31,880 MW of Conventional capacity (Coal-25,580MW and Nuclear-6,300MW) and 179,939 MW of Renewable based Capacity (Large Hydro- 10,462 MW, Solar-131,570, Wind-32,537 MW, Biomass-2,318 MW, Small Hydro352MW PSP-2700 MW) excluding likely Hydro based Imports of 3720MW. The likely BESS requirement is 8,680MW/34,720 MWh during this period.

- Based on generation planning studies the likely Installed Capacity for the year 2026-27 will be 9,591 MW comprising of 273,038 MW of Conventional capacity (Coal- 235,133MW, Gas–24,824MW, Nuclear-13,080MW) and 336,553 MW of Renewable based Capacity (Large Hydro-52,446 MW, Solar-185,566 MW Wind-72,895 MW, Small Hydro-5,200 MW Biomass- 13,000MW, PSP-7446MW) along with BESS capacity of 8,680MW/34,720 MWh.

Grid Scale Battery Storage

- Production of 4,000 MWh of battery storage

- Grid scale Battery storage to reach at 142 Gwh by 2032

- Battery Energy Storage system (BESS) capacity based on RE Generation and transmission system for integration: 47 GW by 2030

EV Charging Infrastructure

- 30% EV by 2030; 80% for two and three wheelers, 70% for commercial cars, 30% for private cars, 40% for buses, and 2.5% for commercial vehicles

- EV Charging Infrastructure after every 25 KM and set up 60,000 charging stations.

- Total estimated EV Chargers by 2030 – 8.95 crs; (94% Private/ Home charges & 58 Lakhs Public chargers)

- 529 GWH – 207 GWH (EV) and 322 GWH (Stationary)

Additional domestic demand drivers

- Indian Railways have a big ambitious plan of building & electrification of about 7,000 Route Kilo Meters (RKM) with an investment of over Rs. 8,000 crs in the next 2 years.

- Smart infrastructure consists of an outlay for Smart city of Rs. 1 trillion and Urban metro network of 1,600 route KM

- Defence sector is also opening for electrical & allied electronics sector procurement from the overall expected outlay of over Rs. 80,000 crs.

Cross sectoral demand will also enhance due to capex growth in core sectors like cement, petrochemicals, metals, data centers, Realty/ buildings etc. in addition to agriculture etc.

Electrical Industry: Indian Electrical and Allied Electronics industry is dominated by T&D segment contributing approx. 65% of the total industry size

% Growth index for Electrical Equipment Industry

Product

FY 23

FY 24

FY 25

Rotating Machines

5.7

3.6

10.2

LV Switchgear

6.1

13.7

14.8

HV Switchgear

-5.5

27.7

16.8

Cables

19.4

23.6

7.8

Power Transformer

13.8

11.8

34.8

Distribution Transformer

21.1

32.8

8.7

Capacitors

-8.3

11.7

-1.6

Energy Meters

15.0

11.4

73.7

Transmission Line Tower

-5.0

16.5

13.8

Conductors

34.4

2.1

4.1

Insulator

-1.9

9.5

7.0

Instrument Transformer

9.6

15.5

128.4

Surge Arrester

-16.9

1.3

-4.1

Overall Growth Index

13.2

17.5

14.1

5200

13080

235133

24824

609591

8,680

Transmission equipment:

- Demand for Transmission equipment covering Transmission line towers, for 400 KV and above. New generation Conductors ( High ampacity conductors) shown growth with increase in the share of the total production.

- Insulators have shown growth mainly for Long rod and Hollow Composite Insulators whereas Surge Arrester showing overall decline of about 4% due to decline in exports however stagnant in domestic orders. Both growths seen for MV and HV segment

Sub-station equipment:

- Growth in High voltage switchgears is mainly from HV & EHV GIS and MV AIS segment with RMUs; mostly from domestic demand coming from state utilities and CPSUs for increasing the sub-station network.

- Good growth for Distribution Transformers supported by RDSS and other scheme and for Power Transformer for increasing the sub-station network in line with the 33GW power Generation capacity addition in FY 25.

- All Power Cables segment, specially EHV, are witnessing a growth due to renewed domestic demand including for railways with support of increased export orders. LD / HW Cables are stagnant.

- HT Capacitors shown decline in production due to low domestic demand however LT Capacitors are stagnant.

Distribution equipment:

- Energy Meters, especially, Smart and prepaid meters are in demand for domestic consumption.

- Low Voltage switchgear has continued its growth trend from last year growth due to sustained demand from Realty, Infrastructure & other manufacturing industries as well as exports.

- Rotating Machines segment stagnant shown growth for FHP and HT Motors, LT Motors are shown slight growth. In LT induction motors more than 99% are energy efficient motors, increase in share of I3 and above motors

Electrical Industry – Import and Export

- The Market has grown at a CAGR of 15% in 5 years

- The total imports have increased by 15% over last year and has a (34%) percentage of Market size.

- The total equipment exports of the country have grown with a 5-year CAGR of 13% and imports have grown at a CAGR of 15% (in Rs terms). However, India’ share in World’s Export still < 1%.

- Major products exported – Power Electronics, Switchgear & Panels, Transformers & TLT

- Exporting Countries – USA, Germany, UAE, UK, France

- Imports for Power Electronics, Transformers & parts, LV & HV Custom built products, Rerating Machines etc

- China still accounts for about 34% share in Imports followed by Germany and Singapore

Voltage class

Transmission line

substation

Unit

Likely addtion

Unit

Likely addition

HVDC

ckm

4300

MW

12000

765KV

ckm

35005

MVA

319500

400KV

ckm

38245

MVA

268135

400KV

ckm

38245

MVA

268135

230/220kv

ckm

46027

MVA

123305

Total Transmission Line

ckm

123577

MVA/MW

722940

Transmission Line and Substations under ISTS & Intra-state capacity addition planned in 2022-27

Type

Unit

Under ISTS

Under Intra-state

Total

Substation

MVA

426675

284265

710940

Transmission Line

ckm

53132

70445

123577

Distribution

- SUMMARY OF DISTRIBUTION INFRASTRUCTURE PLANNED (AS ON MARCH 2022 AND MARCH 2030)

Source : CEA

INDUSTRY UPDATES

- April to September 2025

- April to June 2025

- April to March 2025

- April to March 2024

- April to December 2023 FY23

- April to September 2023 HYFY24

- April to June 2023 FY24

- April to March 2022-23 FY23

- April to March 2022-23

- April to December 2021-22

- April to September 2021-22

- April to June 2021-22

- April to March 2020-21

- April to December 2020-21

- April To September 2020-21

- April To March 2019-20

- April to December 2019-20

- April To September 2019-20

- April To June 2019-20

- April To March 2018-19

- April To January 2018-2019

- April To September 2018-2019

- April to March 2017-2018

- April to January 2017-2018

- April To September 2017-18

- April To June 2017-18

- April to March 2016-17

- April to December 2016-2017

- April to September 2016-2017

India’s Power Sector

Sr

Description

Unit

March-22

March-30

%age Increase

1

Substation Count (66/33/22 KV)

Nos

39,965

52,157

31%

2

Substation Capacity (66/33/22 KV)

MVA

48,2810

62,4332

29%

3

Feeders (66/33/22 KV) Count

No

36,804

54,639

48%

4

Feeders (66/33/22 KV) Length

CKM

59,9304

77,7994

32%

5

Feeders (11KV) Nos

Nos

230979

323899

40%

6

Feeders (11KV) Length

CKM

49,35,279

59,03,782

20%

7

Distribution Transformer (DT) Count

Nos

1,46,74,261

1,93,32,115

32%

8

Distribution Transformer (DT)

MVA

6,89,192

9,27,656

35%

9

LT Feeders (1-Ph & 3Ph)

CKM

79,45,758

9774634

23%

10

Capacitor Bank

MVAR

59,255

1,05,209

78%

11

Consumers (in Crores)

Nos

33

52

58%

Electrical Industry

Representing about 7.2% of the total manufacturing segment in India’s GDP and 45% share in Capital Goods Sector; The electrical and allied electronics industry accounts for over 2.2 million job.

The industry production has grown at about 9.5% CAGR over past 5 years.

Indian Electrical and Allied Electronics industry is dominated by T&D segment contributing approx. 65% of the total industry size

% Growth index for Electrical Equipment Industry

Product

FY 22

FY 23

FY 24

Rotating Machines

24.0

5.7

3.6

LV Switchgear

25.7

6.1

13.7

HV Switchgear

56.1

-5.5

28.9

Cables

21.4

19.4

23.6

Power Transformer

-4.4

13.8

11.8

Distribution Transformer

-4.9

21.1

32.8

Capacitors

35.6

-8.3

11.7

Energy Meters

10.9

15.0

11.5

Transmission Line Tower

0.9

-5.0

16.5

Conductors

-1.3

34.4

2.1

Insulator

-11.5

-1.9

9.5

Instrument Transformer

12.0

9.6

15.5

Surge Arrester

13.1

-16.9

1.3

Overall Growth Index

17.1

13.2

17.6

Transmission equipment

- Demand for Transmission equipment covering Transmission line towers and Conductors ( High ampacity conductors) is seen with pick up in Export orders.

- Insulators have shown growth mainly for Long rod and Hollow Composite Insulators whereas Surge Arrester overall stagnant. Domestic sales for Polymer Surge Arresters shown growth of 75%; decline of about 30% in exports.

Sub-Station equipment

- Growth in High voltage switchgears is mainly from HV & EHV GIS and MV AIS segment; mostly from domestic demand coming from state utilities and CPSUs for increasing the sub-station network.

- Good growth for Distribution Transformers supported by RDSS scheme and around 10% growth in Power Transformers

- LV and MV & HV Power Cables are witnessing a growth of about 23% due to renewed domestic demand including for railways with support of increased export orders. LD / HW Cables are in demand due to pick up in infrastructure projects.

- HT Capacitors production has grown by with sizable growth in Exports however LT Capacitors are slightly down due to quiet domestic demand.

Distribution equipment

- Energy Meters, especially, Smart prepaid meters are in demand for domestic consumption as well as Exports.

- Low Voltage switchgear has continued its growth trend from last year growth due to sustained demand from Realty, Infrastructure & other manufacturing industries as well as exports.

- Rotating Machines segment stagnant over last year’s high growth. LT Motors are shown slight growth however decline for HT Motors. In LT induction motors more than 97% are energy efficient motors.

Electrical Industry – Import and Export

The total equipment exports of the country have grown with a 5 yr. CAGR of 14% and imports have grown at a CAGR of 9% (in Rs terms).

Major products exported – Rotating Machines, Power Electronics, LV Switchgear & Panels, Cable & TLT

- Top Exporting Countries – USA, UAE, Germany, UK, Australia

- Imports increased by 7% in last year especially for Power Electronics, Capacitors, LV & HV Custom built products, Rotating Machines etc.

- China still accounts for about 35% share in Imports followed by Germany and Japan

Source : CEA

Source : CEA

INDUSTRY UPDATES

- April to September 2025

- April to June 2025

- April to March 2025

- April to March 2024

- April to December 2023 FY23

- April to September 2023 HYFY24

- April to June 2023 FY24

- April to March 2022-23 FY23

- April to March 2022-23

- April to December 2021-22

- April to September 2021-22

- April to June 2021-22

- April to March 2020-21

- April to December 2020-21

- April To September 2020-21

- April To March 2019-20

- April to December 2019-20

- April To September 2019-20

- April To June 2019-20

- April To March 2018-19

- April To January 2018-2019

- April To September 2018-2019

- April to March 2017-2018

- April to January 2017-2018

- April To September 2017-18

- April To June 2017-18

- April to March 2016-17

- April to December 2016-2017

- April to September 2016-2017